Compare the Best Pet Insurance Plans for Dogs and Cats

Lemonade is the best pet insurance company for most people. It offers cheap rates and lots of coverage options.

Best pet insurance companies

The best pet insurance companies offer affordable rates with coverage for your pet's specific needs. ValuePenguin compared dog and cat insurance quotes from 11 top companies to find the best insurance for your pet. See the full methodology.

Pet insurance comparison

Cost for dogs

Cost for cats

Plan options

Coverage options

Best pet insurance for most people: Lemonade

-

Dog insurance:

- Low coverage: $16

- High coverage: $53

- Puppy: $53

- Senior: $102

- Low coverage: $12

- Senior: $72

Overview

Pros/cons

Lemonade offers the cheapest rates, along with many ways to upgrade your pet's coverage.

Overview

Lemonade offers the cheapest rates, along with many ways to upgrade your pet's coverage.

Pros/cons

Pros:

-

Cheapest quotes

-

Lots of coverage add-ons

-

Fast online claims

Cons:

-

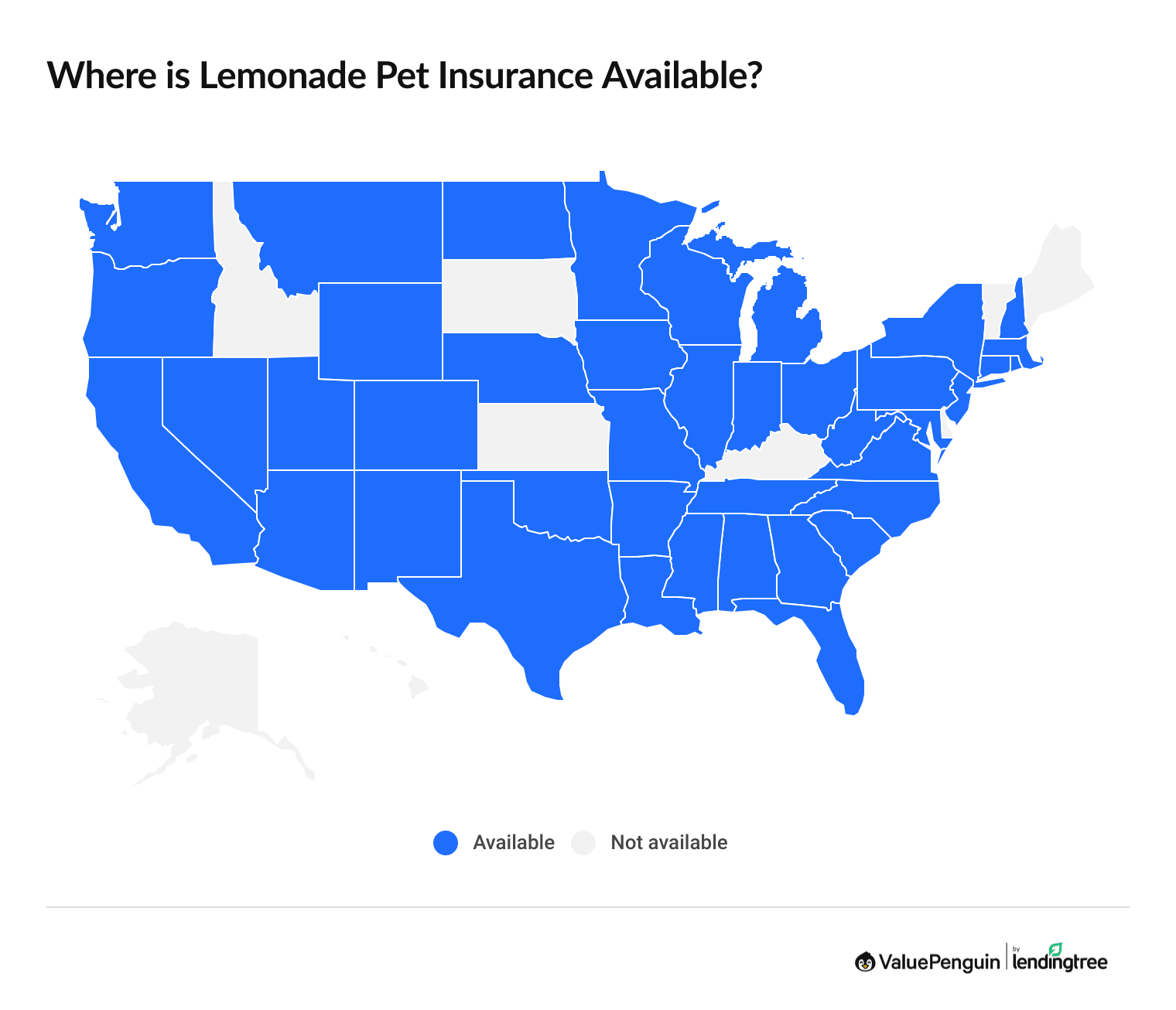

Not available in nine states

Lemonade offers the cheapest rates, along with many ways to upgrade your pet's coverage.

Pros:

-

Cheapest quotes

-

Lots of coverage add-ons

-

Fast online claims

Cons:

-

Not available in nine states Lemonade pet insurance isn't available in Alaska, Delaware, Hawaii, Idaho, Kansas, Kentucky, Maine, South Dakota or Vermont

Lemonade has the most affordable pet insurance rates, along with helpful preventive care add-ons. Basic pet insurance for dogs costs around $16 per month, while cat owners pay $12 per month, on average.

Lemonade pet insurance coverage options

Tier 1 | Tier 2 | Tier 3 | |

|---|---|---|---|

| Base plan | |||

| One wellness exam | |||

| One parasite test | |||

| Three vaccines | |||

| One heartworm or FeLV/FIV test |

You can also add on coverage for vet visit fees, physical therapy, behavioral conditions, dental illness and post-life expenses.

Lemonade is also a great option for puppies and kittens.

It offers a package that includes spaying or neutering, microchipping and up to six vaccines or boosters.

However, Lemonade is available in only 41 states and Washington, D.C. If you can't get Lemonade insurance, you should consider Embrace, which also has cheap rates and good coverage options.

Best customizable pet insurance plans: Spot

- Low coverage: $27

- High coverage: $193

- Puppy: $70

- Senior: $425

- Low coverage: $21

- Senior: $206

Overview

Pros/cons

Spot offers lots of ways to personalize your pet's policy and find coverage within your budget.

Overview

Spot offers lots of ways to personalize your pet's policy and find coverage within your budget.

Pros/cons

Pros:

-

Inexpensive accident-only plans

-

Wide range of deductibles and annual limits

-

Covers curable preexisting conditions

Cons:

-

14-day waiting period for accident and illness coverage

-

Older pets or high coverage limits can be expensive

Spot offers lots of ways to personalize your pet's policy and find coverage within your budget.

Pros:

-

Inexpensive accident-only plans

-

Wide range of deductibles and annual limits

-

Covers curable preexisting conditions

Cons:

-

14-day waiting period for accident and illness coverage

-

Older pets or high coverage limits can be expensive

Spot offers the best insurance if you're looking for flexible coverage. The company offers everything from cheap accident-only coverage to more expensive plans that cover many different types of treatments.

For example, Spot's Platinum plan covers services including dental cleaning, spay and neuter procedures, wellness exams, and flea and heartworm prevention.

Spot pet insurance coverage options

Accident only | Accident + illness | Gold | Platinum | |

|---|---|---|---|---|

| Base plan | ||||

| Breed-specific conditions | ||||

| Chronic conditions | ||||

| Dental illness |

In addition, Spot offers lots of different deductibles and coverage limits you can choose from. These options not only allow you to adjust the amount of money you'll pay out of pocket, but they also affect your monthly rate.

For example, a policy with an unlimited annual coverage will be a lot more expensive than one with a $2,500 annual maximum because the insurance company is at risk of paying a lot more for your pet's care.

Best for older pets: Figo

- Low coverage: $17

- High coverage: $131

- Puppy: $48

- Senior: $237

- Low coverage: $17

- Senior: $159

Overview

Pros/cons

Figo protects older pets who may not be eligible for coverage elsewhere.

Overview

Figo protects older pets who may not be eligible for coverage elsewhere.

Pros/cons

Pros:

-

No age limits for older pets

-

Very affordable basic plans

-

Unlimited coverage and 100% reimbursement available

Cons:

-

Long waiting period for curable conditions

-

Dental coverage is limited

Figo protects older pets who may not be eligible for coverage elsewhere.

Pros:

-

No age limits for older pets

-

Very affordable basic plans

-

Unlimited coverage and 100% reimbursement available

Cons:

-

Long waiting period for curable conditions

-

Dental coverage is limited

Figo is a great option if you have an older pet because it insures pets of any age. In comparison, most insurance companies have maximum age limits for pet health insurance.

The company also offers unlimited annual coverage and 100% reimbursement. That can help owners of elderly pets avoid expensive medical bills. However, these options will make your insurance rates go up.

Figo offers two wellness programs, along with accident and illness coverage.

These programs can help cover the cost of vaccinations, spay or neuter procedures, bloodwork, heartworm prevention and dental cleaning.

Figo has a very short waiting period if your pet has an accident — just one day, which is shorter than most major companies. However, if your pet has a curable preexisting condition, they'll need a clean bill of health for a full year before Figo will pay to treat any new symptoms.

For example, say your dog had an ear infection six months before your policy starts. If he gets another ear infection two months from now, Figo won't cover it.

In addition, Figo's wellness programs don't cover routine dental work. Many other companies allow you to upgrade your policy to include this expense. So if you're worried about paying for routine dental care, you may want to choose a different option.

Best for preexisting conditions: Pumpkin

- Low coverage: $24

- High coverage: $176

- Puppy: $63

- Senior: $387

- Low coverage: $19

- Senior: $185

Overview

Pros/cons

Pumpkin is the best choice for pets with curable preexisting conditions, due to its short waiting period and customizable coverage.

Overview

Pumpkin is the best choice for pets with curable preexisting conditions, due to its short waiting period and customizable coverage.

Pros/cons

Pros:

-

Six-month waiting period for curable conditions

-

Covers alternative therapies, prescription food and supplements

Cons:

-

Won't pay for spay or neutering

-

Can't add routine dental care

Pumpkin is the best choice for pets with curable preexisting conditions, due to its short waiting period and customizable coverage.

Pros:

-

Six-month waiting period for curable conditions

-

Covers alternative therapies, prescription food and supplements

Cons:

-

Won't pay for spay or neutering procedures

-

Can't add coverage for routine dental care

Pumpkin is a great option for pets with a curable preexisting condition. That's because it has one of the shortest waiting periods for preexisting conditions, at 180 days, which is around six months.

If your pet is sick prior to having pet insurance, most companies won't cover ongoing expenses associated with that illness. However, some insurance companies will offer your pet coverage for curable conditions after they've been healthy for a set period of time. This is called a waiting period.

Pumpkin's basic policy also includes more coverage than many other companies.

For example, Pumpkin covers rehab therapies, such as acupuncture and hydrotherapy. It also helps pay for prescription food and supplements, such as joint and bone health vitamins prescribed by your vet.

However, Pumpkin doesn't offer coverage for regular dental cleanings or spay and neuter procedures. So while it's a great option for serious medical care, it may not be as beneficial if you're looking for regular wellness coverage.

Best for multiple pets: MetLife

- Low coverage: $20

- High coverage: $116

- Puppy: $63

- Senior: $152

- Low coverage: $19

- Senior: $148

Overview

Pros/cons

MetLife allows you to insure multiple pets on the same policy, which could save you money.

Overview

MetLife allows you to insure multiple pets on the same policy, which could save you money.

Pros/cons

Pros:

-

Shared deductible across all pets

-

No waiting period for accidents or preventive care

-

Rates are typically affordable

Cons:

-

No coverage for curable preexisting conditions

MetLife allows you to insure multiple pets on the same policy, which could save you money.

Pros:

-

Shared deductible across all of your pets

-

No waiting period for accidents or preventive care

-

Rates are typically affordable

Cons:

-

No coverage for curable preexisting conditions

MetLife is the best option if you have multiple pets because you can insure up to three pets on the same policy. This is helpful because all of your pets will share the same deductible, which can save you a lot of money.

For example, say you have two dogs — Max and Bella — on your MetLife policy, and it has a $250 deductible. If Max gets hurt and has to go to the vet, you'll pay $250 before your pet insurance kicks in. But afterwards, if you have to take Bella to the vet, you won't have to pay any more money out of pocket.

In comparison, if each pet had their own policy, you'd have to pay that deductible twice, for a total of $500.

The one downside to sharing a policy is that your pets will also share the annual maximum coverage amount.

Unlike many other companies, MetLife doesn't have an unlimited coverage option. Its highest limit is $10,000 per year. If you have an older or accident-prone pet, that may not be enough coverage for your full pet family.

Another benefit to MetLife's pet insurance is that there's no waiting period for accidents or preventive care. So you could buy a policy with wellness coverage and take your pet to the vet the following day, and MetLife would still help cover the cost. Most other companies require you to wait around two weeks before you can use your policy.

Best puppy insurance: Fetch

- Low coverage: $31

- High coverage: $122

- Puppy: $50

- Senior: $248

- Low coverage: $22

- Senior: $136

Overview

Pros/cons

Fetch can help pay for spay or neuter surgery, vaccines, and microchipping, which are essential for new puppy parents.

Overview

Fetch can help pay for spay or neuter surgery, vaccines, and microchipping, which are essential for new puppy parents.

Pros/cons

Pros:

-

Option to add coverage for spay or neuter, vaccines, and more

-

Affordable puppy rates

-

Offers coverage for regular teeth cleanings

Cons:

-

Not the cheapest for cats or older dogs

-

Maximum $10,000 annual benefit

Fetch can help pay for spay or neuter surgery, vaccines, and microchipping, which are essential for new puppy parents.

Pros:

-

Option to add coverage for spay or neuter, vaccines, and more

-

Affordable puppy rates

-

Offers coverage for regular teeth cleanings

Cons:

-

Not the cheapest for cats or older dogs

-

Maximum $10,000 annual benefit

Fetch is the best choice if you want to protect your new puppy. That's because Fetch offers wellness care packages that pay for important procedures for puppies, such as spay and neuter surgery, microchipping, and vaccines.

In addition, a basic policy from Fetch pays up to $1,000 per year for behavioral therapy, which could be helpful if your puppy suffers from separation anxiety or aggression. Other companies typically charge extra for behavioral therapy coverage.

Fetch is also one of the more affordable options for puppies, at around $50 per month.

That's 18% cheaper than the average cost to insure a puppy, $61 per month.

However, Fetch policies only cover up to $10,000 of expenses each year. If you're worried about how you'll afford a major emergency, you may want to consider a company with higher limits, such as Lemonade or Figo.

How do I choose the best pet medical insurance plan?

When shopping for pet insurance, it's important to compare quotes from multiple companies to find the best plan for your pet.

Before you get quotes, decide how much coverage you need.

You should choose the same coverage levels with each company so you can make an apples-to-apples comparison.

5 tips to find the best pet insurance

Get pet insurance sooner, rather than later.

Unlike health insurance for humans, pet insurance policies usually don't cover preexisting conditions. If you wait until your pet gets sick to buy coverage, it may be too late to get a plan that will pay for tests and treatment. And some companies don't offer coverage to older pets.

A plan with both accident and illness coverage is often the best choice.

These plans cost more per month. But at some point, your pet will probably need medical care for both types of health issues.

Research your pet's breed history to see if there are any genetic conditions or illnesses your pet is likely to develop.

Then, confirm the insurance company covers that condition. Some plans only cover hereditary or congenital diseases if your pet has insurance before their second birthday.

Read the fine print to make sure you understand what's covered.

For example, does the policy pay for vet visits, diagnosis and treatment fees, and prescriptions? It's important to compare policies because coverage can vary by company.

Understand the plan maximums.

Is there a maximum amount the insurance company will pay per year or per incident? Is there a lifetime limit, or does it reset every year? For example, if your plan resets each year and has an annual limit of $5,000, and your pet needs a $10,000 surgery in any given year, you'll have to pay half the cost.

What to look for when buying pet insurance

A basic pet health insurance plan generally includes accident and illness coverage. However, many companies give you the option to add on wellness or preventive care coverage for an extra cost.

Accident and illness coverage is a good idea for most pet owners. This is especially true if you're concerned about how you'll pay for unexpected vet bills in the future.

But wellness coverage may not be worth the cost, depending on your pet's needs and the price of vet visits in your area.

To find a plan that offers the right benefits for your pet, it's important to understand what each plan includes and anything that's not covered.

Preexisting condition

A preexisting condition is an illness or injury that your pet had before your plan coverage started, or before the initial waiting period was over.

Pet insurance plans typically don't cover preexisting conditions. That means if symptoms started before you bought pet insurance, insurance won't cover any associated costs. However, some plans will treat any healable or curable disease after a waiting period.

Incident

An incident is a broad term that means any medical event leading to vet exams or office visits, blood work, treatment plans, medications, hospital stays and follow-up visits.

Accident

An accident is typically an unexpected incident that you can't prevent. Pet insurance for accidents can cover emergencies including broken bones, burns, swallowed objects, poisoning and broken teeth.

Illness

An illness is any general sickness, disease, infection or medical problem that isn't an accident. Examples include allergies, diabetes, heart disease, upset stomach, skin bites and cancer.

Chronic condition

A chronic condition is a medical condition that requires ongoing care. Allergies, cancer and hip dysplasia are some examples of chronic issues.

Hereditary condition

Certain breeds are more likely to develop specific illnesses, called hereditary conditions. Plans may not cover hereditary conditions for your pet's breed. And there may be an extra deductible if insurance does cover the condition.

Some insurance plans even exclude associated or secondary diseases related to hereditary issues.

For example, Labrador retrievers, golden retrievers and German shepherds tend to develop epilepsy more often than other breeds. So an insurance company might not cover issues related to it.

Congenital condition

A congenital condition is a defect or unique condition that your pet is born with. For example, congenital kidney disease, or familial renal disease, is common in shih tzus.

Alternative or holistic therapy

Alternative or holistic therapy can include chiropractic treatments or acupuncture. Some plans cover any kind of care recommended by a vet. But others exclude these alternative treatments.

Wellness

Wellness care is anything that generally keeps your pet from developing a health condition. Wellness treatments typically include vaccines, dental care and treatment for fleas, ticks and heartworms. Pet insurance companies usually offer this as an optional add-on or include it in their upgraded packages.

Exclusions

Sometimes, the number of items excluded under insurance plans is bigger than the number of items covered. Common exclusions are declawing, accidents or injuries caused by pet owners, and administrative fees related to vet visits.

Waiting period

Most plans have a waiting period before you can start getting benefits. It is typically around 14 days.

How much pet insurance coverage do I need?

To decide how much pet insurance you need, you have to consider how much you can afford on a monthly basis as well as in an emergency. The more protection you have, the more you'll pay for coverage.

The amount your insurance will reimburse you after a vet visit depends on three main factors.

Most companies offer lots of options when it comes to deductibles, reimbursement percentages and coverage limits.

If you're comparing pet insurance quotes online, it's easy to choose different coverage limits and see how they change your monthly rate. Doing this can help you make a decision about the right level of coverage for you and your pet.

It's also important to look at the specific coverage options offered by each company. Some pet insurance companies don't cover preexisting or hereditary conditions, such as hip dysplasia.

The best pet insurance companies offer add-ons that you can use to take care of your pet's specific needs.

Frequently asked questions

What is the best pet insurance?

Is it worth shopping around for pet insurance?

Pet owners should always compare insurance companies to find the best price and policy for their pet. Some companies are much more expensive than others. For example, Lemonade offers puppy insurance for around $34 per month, while a policy from Nationwide costs $80 per month.

But the coverage offered by each company is also different. It's important to find a policy that offers the right coverage for your pet.

Who has the best pet insurance for multiple pets?

MetLife offers great coverage for multiple pets because you can insure up to three pets on the same plan. That can help you save money because you'll need to pay your deductible only once.

Methodology

To find the best pet insurance, ValuePenguin editors gathered quotes from 11 of the largest pet insurance companies that offer online quotes. Rates are for a range of pet profiles, including a 2-year-old chihuahua, a 9-year-old golden retriever and 3-year-old domestic shorthair cat.

Quotes are for basic accident and illness coverage. ValuePenguin collected quotes for a plan with low coverage limits and higher coverage limits, as follows:

Low coverage | High coverage | |

|---|---|---|

| Annual reimbursement | $5,000 | $Unlimited, or highest available |

| Reimbursement | 80% | 90% |

| Deductible | $250 | $500 |