Georgia Moped and Scooter Laws

There are different laws for mopeds, scooters and electric bikes in Georgia. Mopeds, which have engines smaller than 50cc, require licenses... Read More

Finding a car insurance company based near you can come with a lot of benefits.

Smaller regional companies tend to offer cheap rates and reliable customer service. You might find it easier to work with an agent whose office is nearby versus someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

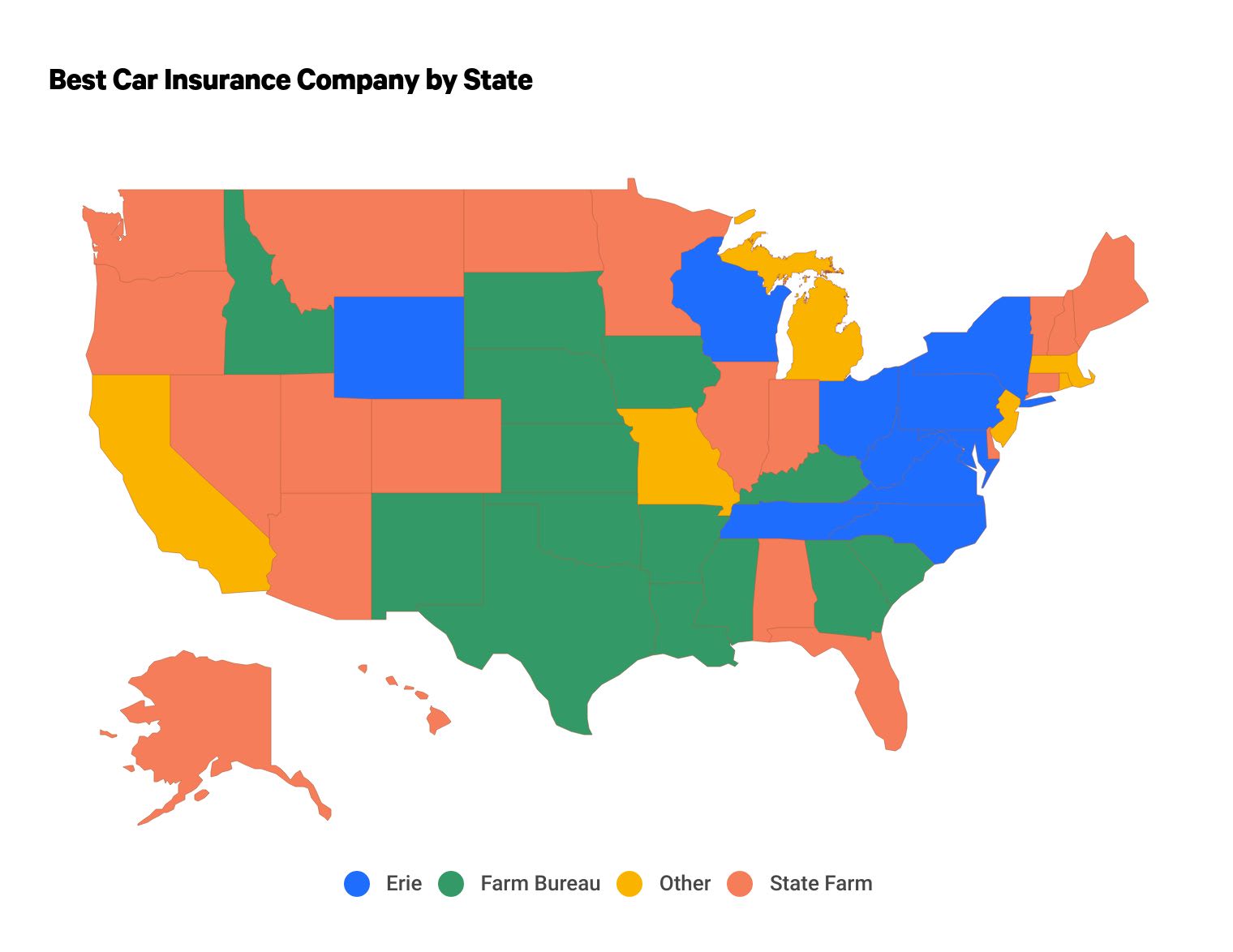

State Farm is the best car insurance company in 21 states based on customer service reviews, coverage availability and the overall value it provides to drivers across the country.

However, the best car insurance near you may be different. Farm Bureau and Erie offer dependable customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Where you live can have a big impact on your car insurance rates. For example, drivers in Vermont pay $92 per month for full coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $399 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

There are different laws for mopeds, scooters and electric bikes in Georgia. Mopeds, which have engines smaller than 50cc, require licenses... Read More

The minimum amount of car insurance you're required to purchase varies by state. The average cost of minimum-coverage insurance is $65 per... Read More

A Zipcar rental includes the legal minimum for car insurance in every state. However, adding onto the base coverage will protect you... Read More

Home insurance companies usually cover woodstoves or pellet stoves as long as they're professionally installed and inspected.... Read More

Chubb has excellent customer service and coverage options, but its auto and home insurance is expensive. It's best suited for... Read More

If you’re looking for car insurance, some insurance companies will assess your application with an auto insurance score. This guide... Read More

Insurance binders provide temporary evidence of insurance for assets such as cars, homes and commercial property. Insurance binders serve... Read More

Lemonade is the best cheap renters insurance company in San Diego. Its average price is $8 per month — less than half the city's average... Read More

Dairyland Insurance is a poor choice for most drivers because of expensive auto and motorcycle insurance rates, subpar customer service and... Read More

Senior burial insurance is a whole life insurance plan designed to offer coverage for end-of-life expenses.... Read More

Your mortgage company will require you to have home insurance. And it's a good idea to have home insurance even if your home is paid... Read More

DUIs are considered serious crimes in Pennsylvania, even for your first offense. But repeat offenders and drivers with very high blood... Read More

Allied was an insurance company owned by Nationwide that had affordable rates and useful discounts. In 2020, it was absorbed by Nationwide... Read More

Amica has the best insurance for Boston renters. A policy from Amica costs around $19 per month. The company also offers lots of discounts... Read More

The average cost of auto insurance for a 2022 Ford is $3,171 per... Read More

Flood insurance usually has a waiting period of 14 to 30 days. There's a 30-day waiting period for federal flood insurance. Private flood... Read More

The average flood insurance policy in Minnesota costs $958 per year for a policy from the National Flood Insurance Program (NFIP). That... Read More

Can you still access your equity after paying off your mortgage? We cover the things you should keep in mind when it comes to cashing out... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, a smaller regional company like Auto-Owners, Erie or Farm Bureau may have the cheapest rates near you.

This depends on how you prefer to communicate with your insurance company. If you're looking for a one-on-one relationship, or prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you're more comfortable managing your insurance with an app and prefer virtual chat to phone calls, you may not benefit from working with a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.